Overview

MYOB

AccountRight V2 uses REST API for its integration. This integration

supports:

-

-

MYOB

AccountRight Online (Cloud)

-

MYOB

AccountRight Offline (Local)

Refer

to

MYOB Website

for more information.

Integration modules and configurations for MYOB AccountRight V2

-

-

"BillMiscellaneous.TaxCode" - Tax Code used for

creating transactions that have a tax amount greater than zero.

-

"BillMiscellaneous.TaxCodeExempt" - Tax Code used for

creating transactions that have a tax amount equal to

zero.

-

-

-

"GLJournal.TaxCode"

- Tax Code used for creating transactions. This is used where a tax

code does not exist in LinkSOFT, and is required. E.g Creditor invoices from

Payroll.

-

-

-

"GLJournal.TaxCode"

- Tax Code used for creating transactions. This is used where a tax

code does not exist in LinkSOFT, and is required. E.g Creditor invoices from

Payroll.

-

-

"GLJournal.TaxCode" - Tax Code used for

creating transactions. This is used where a tax code does not exist in

LinkSOFT, and is required. E.g Creditor invoices from Payroll.

-

"TaxRoundingVariance" -

Tax rounding variance is added to the line with highest tax when the

variance is within this amount.

MYOB API does not have line tax,

therefore, we have to calculate and distribute tax. This configuration deals

with rounding variance.

-

General Ledger

Journals

-

"GLJournal.TaxCode" - Tax Code used for

creating transactions. This is used where a tax code does not exist in

LinkSOFT, and is required. E.g Creditor invoices from Payroll.

-

- Tax Master

Steps to configure MYOB API

-

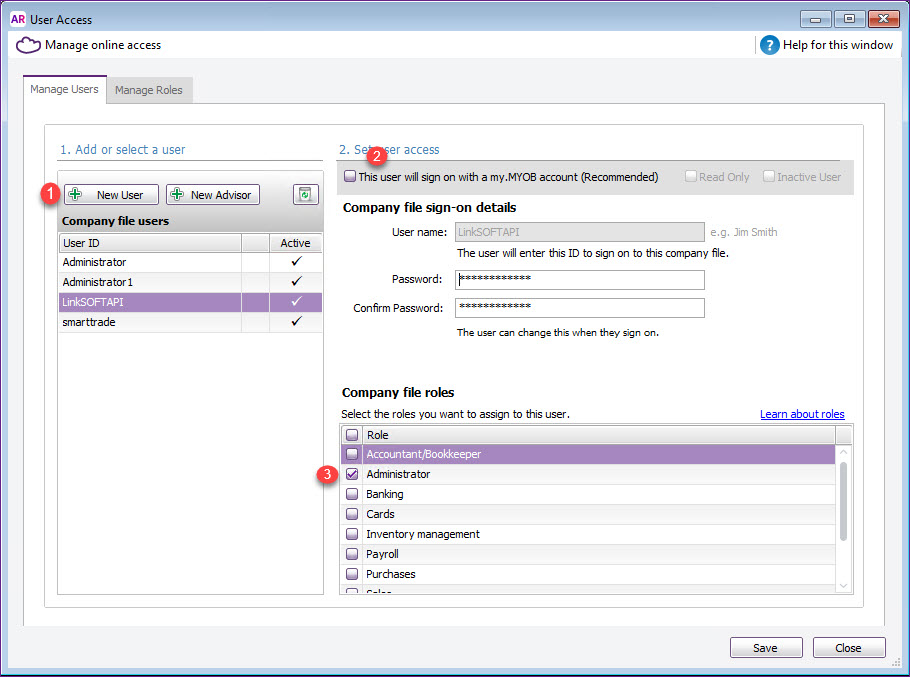

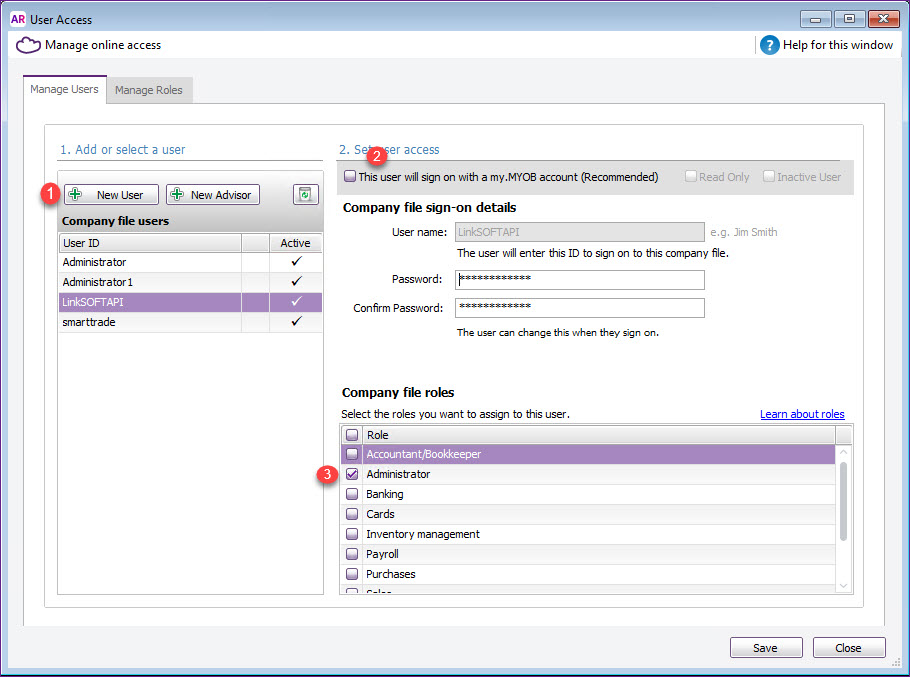

Create a

user for LinkSOFT

API in MYOB. This user will be used by LinkSOFT integration. Refer

to Figure 1 below.

Login to MYOB AccountRight and goto "Setup -> User

Access".

1. Add New User

2. Untick "This user will sign on with a

my.MYOB account"

3. Assign "Administrator" role to the

user.

Figure 1: User

Access

Obtain the "Serial Number"

and "Company Name". This is required for MYOB online file

options. Refer to Figure 2

below

Figure 2: Company Information

Steps to configure integration to MYOB AccountRight Offline

(Local):

- When

accessing the API via the desktop, ensure that MYOB and its prerequisites

are installed. Refer to MYOB install guide for details.

- Configure the following under "MYOBAccountRightV2.API -> General

Settings". These details are provided by your systems provider.

-

Base

URL - Enter the URL to indicate the company file.

- For

example: http://localhost:8080/AccountRight/db39da50-1ff1-495a-bff3-9060b947d24f/

- Type this

link " http://localhost:8080/AccountRight/" in the browser where MYOB is

installed. This will load the list of company files in MYOB.

-

Copy the full "URI" of the company file as the "Base

URL" for integration.

-

The "Base URL" should end with a forward slash "/"

-

Authorization -

Enter the username and password for the MYOB

company file in the format

USERNAME:PASSWORD.

-

Enable

the modules that is required for integration.

Steps to configure

integration to MYOB AccountRight/Essentials Online (Cloud):

-

Ensure that the MYOB

"Company Name" matches with the "Registered Company Name" in menu "Global

Administration -> Company"

-

Configure the following

under "MYOBAccountRightV2.API -> General Settings". These details are

provided by your systems provider.

-

Authorization -Enter the username and password for the MYOB

company file in the format

USERNAME:PASSWORD.

-

Enable Authorization using

oAuth2 then configure the following:

-

API Key - API key provided by your oAuth

Provider. You can also use Link Technologies API Key

[2yeevsajxdbgwbzfey6b264t]

-

API Secret - API secret provided by your oAuth

Provider. You can also use Link Technologies API Secret

[bKPKf7vSptXnvPwySNvDWcCq]

-

Redirect URL - URL for

redirection after oAuth Authorisation. Full LinkSOFT URL ending with

/Framework/IntegrationAuthorisation.aspx.

If you are

using "Link Technologies API Key" then the "Redirect URL" must be

"http://localhost/LinkWEB/Framework/IntegrationAuthorisation.aspx"

-

Serial Number - Enter the serial number for the

company file.

-

Click on "oAuth2 Request"

and authenticate the integration with your company file.

-

Enable the modules that is

required for integration.

Also

See:

-

Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation